How To Budget For A Baby: A Comprehensive Guide

Are you expecting a new addition to your family? Congratulations! Welcoming a baby into your life is an incredibly exciting time, but it can also bring financial challenges. From diapers to daycare, the costs of raising a child can add up quickly. In this article, we will discuss how to budget for a baby and ensure that you are financially prepared for this new chapter in your life.

Knowledge

When it comes to budgeting for a baby, the key is to plan ahead and be realistic about your expenses. Here are some essential tips to help you create a budget that works for your growing family:

Before your baby arrives, take a close look at your current financial situation. Calculate your monthly income, expenses, and savings to determine how much you can afford to allocate towards baby-related costs. This will give you a clear picture of where you stand financially and help you set realistic budgeting goals.

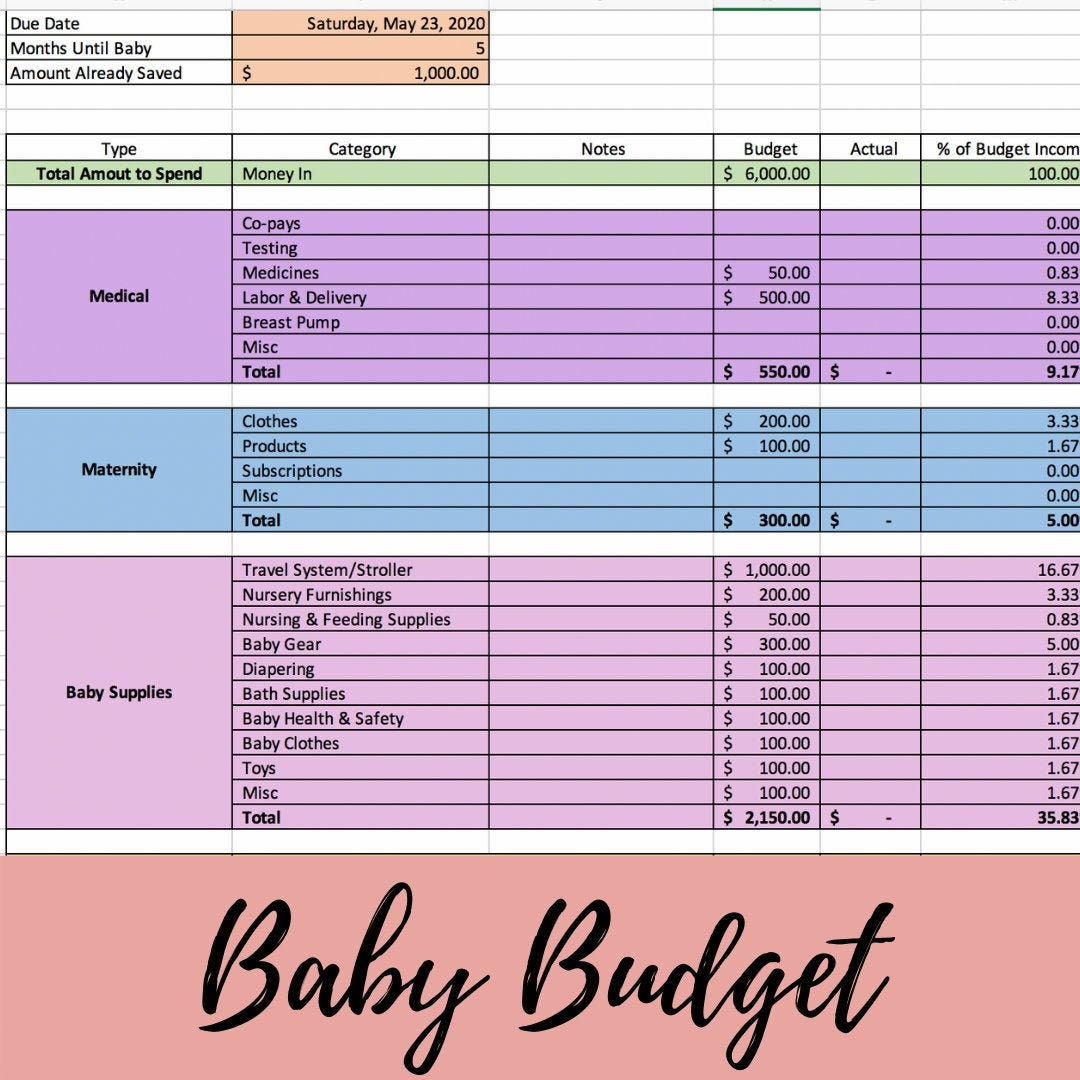

Once you have assessed your finances, it’s time to create a budget specifically for your baby. Make a list of all the essential items you will need, such as diapers, formula, clothing, and nursery furniture. Research the average costs of these items and allocate a portion of your budget to each category. Don’t forget to include ongoing expenses like healthcare, childcare, and education savings.

It’s never too early to start saving for your baby’s future. Consider opening a dedicated savings account or investment fund to set aside money for their education or other long-term expenses. Automate your savings by setting up regular transfers from your checking account to your baby savings account to ensure that you are consistently putting money away.

To make room in your budget for baby-related expenses, look for areas where you can cut costs. This could involve reducing dining out, canceling subscriptions you don’t use, or finding more affordable alternatives for everyday items. By making small changes to your spending habits, you can free up extra money to put towards your baby budget.

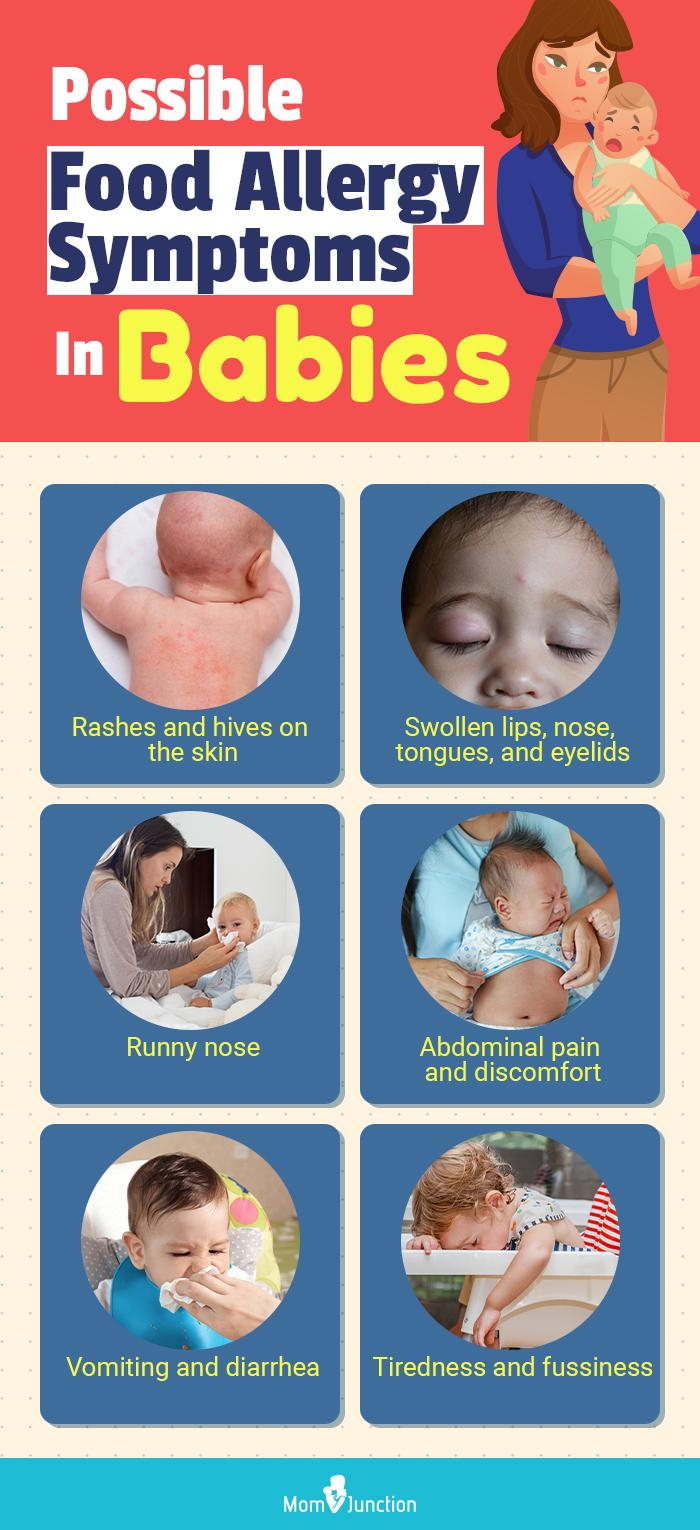

Life with a baby can be unpredictable, so it’s essential to have a financial safety net in place. Consider setting aside some money in an emergency fund to cover unexpected expenses like medical bills, home repairs, or job loss. Having a cushion of savings will provide peace of mind and financial security for your growing family.

Conclusion

Creating a budget for your baby is a crucial step in preparing for their arrival. By evaluating your finances, creating a baby budget, starting to save early, cutting costs where you can, and planning for unexpected expenses, you can ensure that you are financially prepared to welcome your new bundle of joy.

Remember, every family’s financial situation is unique, so it’s essential to tailor your budget to fit your specific needs and circumstances. With careful planning and smart financial decisions, you can enjoy the journey of parenthood without the stress of financial worries.

In conclusion, budgeting for a baby is an essential aspect of preparing for parenthood. By taking the time to assess your finances, create a realistic budget, and plan for unexpected expenses, you can set yourself up for financial success as you embark on this new chapter in your life. Remember, being financially prepared will allow you to focus on what truly matters – creating lasting memories with your little one.